CBO Concludes: Reducing National Debt Will Grow the Economy (Duh!)

Earlier this month, House Budget Committee Chairman Paul Ryan (R–Wis.) proposed a budget for 2015 that contains more than $5 trillion in savings over the course of 10 years.

Naturally, liberals were quick to criticize Ryan’s budget, saying it was “heartless” and that it would tank the economy.

But here’s the funny part… The Congressional Budget Office (CBO) analyzed Ryan’s proposed plan and concluded that it would actually be good for the economy. They wrote:

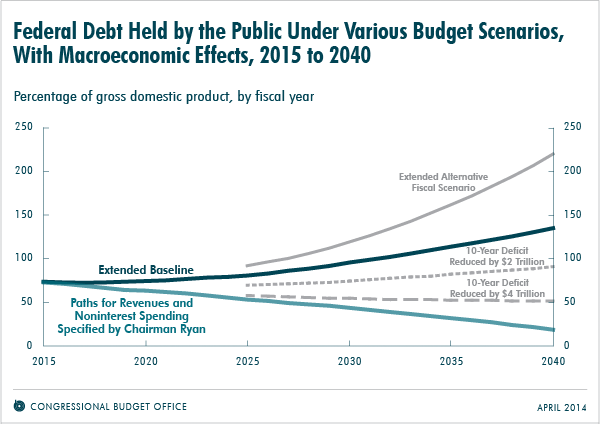

Over time, lower federal debt leaves more funds available for private investment and thereby causes output to be higher than it would be otherwise. Higher federal debt has the opposite effect, “crowding out” private investment and decreasing output.Under the paths for revenues and noninterest spending specified by Chairman Ryan, the amount of federal debt held by the public would be smaller in all future years than it would be under CBO’s extended baseline projections or under the three alternative budget scenarios that CBO analyzed.

They even created a chart to illustrate the positive outcomes of Ryan’s proposed budget.

While the CBO points out that Ryan’s budget cuts would “generally reduce total demand for goods and services” in the short-term, they also point out that Ryan’s “policies would [positively] affect people’s well-being in various ways beyond the effects on overall economic output.”

Said another way, debt is a major drag on the economy. The more we can reduce that debt, the greater our overall economic output will be. And viewed in that light, Ryan’s plan seems to be a good one indeed.

No comments:

Post a Comment

Thanks for commenting. Your comments are needed for helping to improve the discussion.