Capital Controls And 200 Percent Price Rises in Ukraine — And Ukraine Is In Better Shape Than The U.S.!

THINKSTOCK

In a TV address to a torn nation, Ukraine’s prime minister, Arseniy Yatsenyuk, first implied heating prices would rise incrementally, and then later confirmed a plan to increase prices 100 percent in the next two years (and nearly 200 percent by 2017), as the cost of imported Russian gas is expected to rise to $500 from the current $84.

Not only did Ukrainians have the hard rug of the consequences of statism pulled out from underneath them, but the move was followed with tougher capital controls, which restricted cash purchases to $1,300 per person per day after the Central Bank said “amid a tense situation in money markets” it is now broke. (We covered a reported shipment of gold out of Ukraine a couple of weeks ago.)

The Ukraine Central Bank implements capital controls:

- Sets limits on foreign currency purchases.

- Limits purchasees to 15,000 Hryvnia per person per day ($1,300).

- Ukraine central bank limit purchases to 150,000 Hryvnia per person per month ($13,000).

Oh, yeah, and they’re broke.

In a joint European Union/United States statement, the two powers said Ukraine “requires consolidation of all reform efforts.” The austerity measures came the day before it was announced Ukraine had “won” a $27 billion international financial credit line. From Reuters:

The International Monetary Fund announced a $14-18 billion standby credit for Kiev in return for tough economic reforms that will unlock further aid from the European Union, the United States and other lenders over two years, effectively pulling Kiev closer to Europe.

Russian gas prices are expected to increase for Ukraine, as Russia has grown less interested in providing Ukraine with gas subsidies. The International Monetary Fund stated one of its first goals would be “cleaning up Ukraine’s opaque energy giant Naftogaz, which imports gas from Russia’s Gazprom.” Naftogaz’s chief executive was arrested last week in the United States in a corruption probe.

A Comparison Of The Ukraine To The U.S.

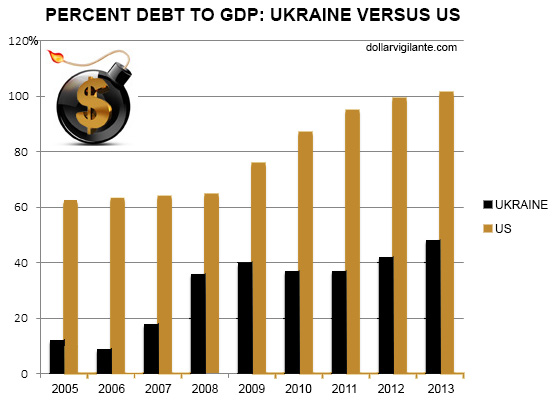

Many Americans may think that tremendously rising prices and overt capital controls cannot happen in the United States. Let’s compare the total debt to gross domestic product of Ukraine, a country considered to be bankrupt, with the United States.

That’s right. The U.S. has more than double the debt to GDP that Ukraine has.

How is it that there aren’t riots in the streets and a government in the U.S. on the verge of a collapse? Mostly, media and institutionalized brainwashing have, so far, limited the riots. As for a collapse of the U.S. government, the only thing keeping its entire evil empire functioning is a still widely accepted U.S. dollar.

And that is all changing dramatically now, too. Russia and China have made very vocal statements about their desire to stop using the U.S. dollar. Of course, many oil-producing countries such as Iraq and Libya wanted to also move off the petro dollar. We all know what happened there. And, the prince of peace, Barack O’Bomber, is currently in Saudi Arabia likely making threats and bribes to ensure they stay onside with the dollar.

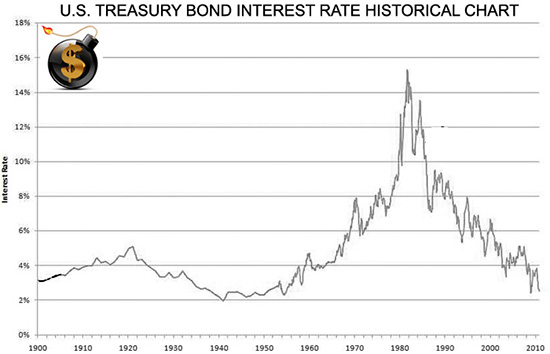

In any case, the end of this gargantuan U.S. government and the U.S. dollar is nigh. With a debt of more than $17 trillion, all it would take is for interest rates to rise to 10 percent, and almost every penny of extorted money (taxes) that the U.S. government collects would go to interest payments on the debt alone.

During the 1970s, a similar time in history, interest rates were allowed to actually go to their market levels and topped out at 18 percent.

That is why Federal Reserve Chairman Janet Yellen must manipulate interest rates as low as possible for as long as possible. There is a massive amount of debt in the United States now, and even an interest rate of 5 percent would likely implode the entire financial system and the government itself.

Keeping rates near 0 percent and printing money via Quantitative Easing in order to fund the government will eventually lead to hyperinflation.

The End Of The Monetary System As We Know It (TEOTMSAWKI)

All of the actions pertaining to the Ukraine today are all symptomatic of the end stages of TEOTMSAWKI.

The West has implemented numerous sanctions on Russia. Visa and MasterCard stopped providing services for payment transactions for clients at Bank Rossiya, due to U.S. sanctions; and Putin said last Thursday that Russia would develop its own credit card system.

It is all just rearranging the chairs on the deck of the Titanic, however, as far as the U.S. government and the U.S. dollar are concerned. The U.S. government is in much worse shape than Ukraine fiscally. And as the rest of the world begins to move away from the dollar, it will be game over for the current financial and monetary system in the United States.

Many Ukrainians with assets are probably wishing now that they had moved some assets into bitcoin, had purchased some precious metals and had them outside of their home country (see The Dollar Vigilante’s “Getting Your Gold Out Of Dodge”) and had opened a foreign bank account in a much less indebted and taxed region (as you can get from TDV Offshore).

Americans still have an opportunity to do all those things, but the doors are closing rapidly. The Foreign Account Tax Compliance Act (FATCA), coming into effect on July 1, will be the first major door to close. For that reason, if you still have a sizable amount of assets inside the United States or in any Western country, you should consider attending the Crisis Conference to find out how not to get Cyprused… or, now, Ukrained.

No comments:

Post a Comment

Thanks for commenting. Your comments are needed for helping to improve the discussion.