The false economic recovery narrative will die in 2017

Yes, the narrative of the “new normal” has been around for so long now that many people have simply grown used to it. The assumption is that the fiscal “new normal” has become the fiscal “normal,” and though the fundamentals continue to strain under the weight of poor global demand and historic debt levitated by extraneous fiat stimulus, the masses feel far less fear than is warranted. Hey, why should they? We’ve managed around eight years skating on thin ice, why shouldn’t we expect eight more years of the same?

The banking elites have done the job they set out to do, which was to drive the economy to the very edge of the financial cliff, and then keep it suspended there until the general public became comfortable living next door to the abyss.

Why do this? Well, the greater dynamic at play here is something the average person will not understand or refuses to examine — economics today is about mass psychology. The economy is a tool, or a weapon, by which international financiers can influence the public mind and the emotions of the mob. In order to grasp the mechanics of economics it is not enough to deal in statistics and trade principles; one must also grasp human behavior and how it is manipulated. One must acknowledge that in economics we witness the transmutation of societies by word and by force, by chaos and by order. Economics is alchemy.

The globalists (in their twisted view) seek to change lead into gold, and just as in alchemy, these elements are a metaphor for psychological evolution. For the globalists, social engineering is a form of witchcraft; they see it as creation, or a grand form of architecture.

But it is not creation. The globalists are incapable of such art because true art requires wisdom and empathy. All they know is how to deconstruct existing systems generated by nature and free men and rearrange the left over pieces into something more oppressive and ultimately less interesting than what existed before. Give the internationalists a Mona Lisa and they will shred it, reconstitute it and regurgitate a paint by numbers coloring book.

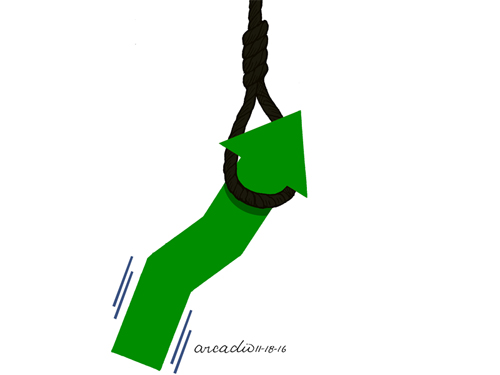

The globalists only know how to turn gold into lead.

If you do not understand the reality of globalist influence in markets and the nature of economics as a weapon; if you actually believe that the economy operates purely on some kind of free-roaming free market principles, then you will never be able to wrap your head around the otherwise absurd behavior of our financial structure.

The psychology of fiscal “recovery” is a vital tool for change and for developing false dichotomies. For example, I recently came across this article from the pervasive propaganda hub of Bloomberg. In it, Bloomberg outlines a story we are by now very used to hearing from the mainstream — that the presidential era of Barack Obama has left the economy of the U.S. in particular in “far better shape” as he leaves office than when he entered office.

Now, anyone who has been reading my analysis for at least the past six months (if not the past ten years) knows exactly what I think about the current state of the economy and what is likely to happen in the near future. For those new to my position, here is a very quick summary along with linked evidence supporting my claims:

From the 1990’s leading into the year 2007, the Federal Reserve engineered a massive debt and derivatives bubble through the use of artificially low interest rates in the housing market. Alan Greenspan, the presiding Fed chairman at the time, openly admitted in interviews that the central bank knew an irrational bubble had formed, but claims they assumed the negative factors would “wash out.” This is a constant meme set forward by the Fed — that they were essentially too stupid to foresee a collapse of the bubble they knew they had created. They prefer that the public believes that the Fed was “incompetent” rather than deliberately destructive.

The low rates fueled a machine of mortgage backed securities and derivatives based on trillions of dollars in loans to people that had no ability or no intention of ever paying them back. The Fed had aid in this program from the ratings agencies, which labeled obviously toxic debt as AAA for years, and the SEC, which refused to investigate any legitimate claims of asset manipulation and ill intent. This corrupt behavior on the part of the SEC was showcased in the testimony of SEC whistle blower Gary J. Aguirre, who warned of dangerous debt pools and manipulation within the banking industry in 2006 before the derivatives collapse and also warned that the SEC interfered with any investigation attempts into the problem.

This led to the well known “Great Recession” triggered in 2007/2008. The Fed along with numerous other central banks around the world had conjured a crisis and then offered their own solution to that crisis. Namely, the solution of massive fiat stimulus programs purchasing toxic debt, treasury bonds, corporate stocks and anything else that wasn’t nailed down.

The “bailouts” and quantitative easing projects, however, were actually cover for a far larger program of untold trillions in overnight loans to corporations domestic and foreign. A never-ending river of dollars created out of thin air and pumped into companies for near zero interest. It was these free overnight loans that allowed international conglomerates to purchase their own stocks through stock buybacks, thus reducing the number of existing stocks on the exchanges and artificially boosting the price of the remaining stocks. This caused stock markets to skyrocket from near death to historic highs.

In the meantime, government bureaucracy has worked tirelessly to manipulate statistics to falsely reflect an overall recovery. While some numbers slip through the cracks and issues of true supply and demand continue, the vast majority of the populace has little clue that the collapse of 2008 never actually stopped, it was just shifted into a state of slow motion.

The Fed’s low interest rates, specifically on overnight loans, has allowed the economy to sputter along for eight years, and has greatly enriched the top 1 percent in the process. But now, their strategy is changing.

The problem is that stimulus has a shelf life, and while certain stats can be misrepresented and the stock market can be inflated for a time, eventually, consequences must be accepted for attempting to defy gravity for so long.

The initial collapse was designed to foster an even greater event. Without the derivatives bubble, the central banks never could have convinced the masses to accept the idea of a fiat stimulus bubble which would eventually put the dollar at risk, along with the overall U.S economy. Taking the brunt of the 2008 crash would have been painful, but not insurmountable. But with eight more years and tens of trillions in added debt along with increased geopolitical tensions and an equities bubble for the ages, the scale of the final collapse will be truly unprecedented.

The purpose of this final event will be to generate so much chaos and desperation that the public will be compelled to search for extraordinary solutions. The globalists will be ready with those solutions, including those they have openly outlined decades in advance in publications like The Economist.

The end game? The formation of a single monetary and economic authority under the management of the International Monetary Fund, and the establishment of a single global currency using the IMF’s Special Drawing Rights as a “bridge” for locking national currencies into a harmonized exchange rate until they become pointless, interchangeable and replaceable.

The problem is, the globalists cannot possibly initiate this end game in a vacuum, otherwise, they would take the blame for the inevitable collateral damage to people’s lives as their “great global reset” is undertaken. The globalists need a scapegoat.

Enter Donald Trump, the Brexit Referendum, and the rise of “populist” movements. For the entire first half of 2016, globalists were “warning” non-stop that a rise in populism (conservatives and sovereignty champions) would result in international financial catastrophe. It was as if they knew that the Brexit would succeed and that Donald Trump would win the election…

This has been my position for the past half year — that globalists were planning to allow conservative and sovereignty movements to take the reigns of power, that they would allow the passage of the Brexit and the rise of Trump, just before they pull the plug on the system’s life support. The Federal Reserve in particular has already launched the final phase by beginning a series of rate hikes which will remove the safety net of free overnight loans to companies, thereby sabotaging equities markets. I specifically warned about this over a year ago when most analysts were stating that negative rates and QE4 were “just around the corner.”

And this is where we are today. As noted above, Bloomberg writes an interesting bit of propaganda starting with a bit of truth. Here’s the beginning quote from their article:

“Research suggests factors beyond the control of any U.S. president, not their actual policies, set the course of the economy. Yet with voters, President-Elect Donald Trump will secure much of the praise or blame when it comes to the impact of his agenda over the next four years.”

The recovery narrative from 2008 to today was imperative to the globalist’s greater agenda. For a considerable portion of the public must be made to believe that under a socialist and decidedly globalist president (Barack Obama) the general trend in the economy was positive and that “things were getting better.” This sets the stage for the final collapse and the IMF’s great reset, in which conservatives and sovereignty activists will be blamed, whether there is any evidence of culpability or not, for the crash that the globalists have spent the better part of two decades setting in motion.

After the dust has settled, the argument will be that the world was on course before the Brexit, before Trump and before populism. The argument will be that globalism was working and conservatives screwed it up with their selfish nationalist endeavors. After the final crash and perhaps numerous deaths from poverty and violence, the argument will be that the only conceivable solution must be a return to globalism in an extreme form; or total global centralization, so that such a tragedy will never happen again.

Bloomberg helps to set up the scenario, by claiming that Trump is “inheriting” a stable and improving economy compared to the economy that Barack Obama inherited:

“While today’s economy is a mixed bag by historical standards, one thing is clear: Obama has left Trump a 2016 economy in a better state, by many measures, than when he was first elected president in 2008 in the middle of the worst downturn since the Great Depression.”

Of course, Bloomberg fails to mention that the standards and statistics by which they measure economic “improvement” are entirely fraudulent.

For example, real GDP is at -2 percent, not +2 percent as Bloomberg claims, when one calculates for distortions such as government spending, which is counted towards GDP even though government does not actually produce anything. Government can only steal productivity from citizens and reassign that wealth elsewhere.

Bloomberg also cites a vastly improved unemployment rate. They once again refuse to bring up the fact that over 95 million Americans are no longer counted as unemployed by the Bureau of Labor Statistics because they have been jobless for so long they do not qualify to be included on the rolls. This lie of reduced unemployment has been pervasive through the entirety of the Obama Administration.

Bloomberg then mentions a greatly improved housing market that Trump will enjoy when he takes office. They certainly do not include the fact that pending home sales are now plummeting. And, they do not mention that the majority of the boost in home sales during Obama’s two terms was due to corporations like Blackstone buying up distressed mortgages and turning the homes into rentals. The housing market is not being supported by individuals and families seeking home ownership, but corporations snatching up real estate on the cheap and driving up prices.

And there you have it. The globalist setup continues with mainstream outlets telling Americans that the economy is in ascension as Trump and populists move into positions of power, when in truth the economy is as dire as it ever was if not worse off. The false recovery narrative will indeed die in 2017, and it will be because the globalists want it to die while nationalists are at the helm. This is perhaps the biggest con game in recent history; with conservatives as the fall guy and the rest of the public as the gullible mark. One can only hope that we can educate enough people on this scenario to make a difference before it is too late.

— Brandon Smith

No comments:

Post a Comment

Thanks for commenting. Your comments are needed for helping to improve the discussion.